Chipotle’s stock experienced a significant increase due to its strong financial performance and growing popularity. Investors are attracted to its innovative business strategies and consistent revenue growth. Chipotle, as a leader in the fast-casual dining sector, continues to expand its offerings and enhance customer experiences, leading to positive market sentiment. People who want to make money in the restaurant business will probably continue to buy Chipotle stock because the company intends to use healthy ingredients and be good for the environment.

Chipotle’s stock experienced a significant increase due to its strong financial performance and growing popularity. Investors are attracted to its innovative business strategies and consistent revenue growth. Chipotle, as a leader in the fast-casual dining sector, continues to expand its offerings and enhance customer experiences, leading to positive market sentiment. People who want to make money in the restaurant business will probably keep buying Chipotle stock because the company intends to use healthy ingredients and be good for the environment.

Table of Contents

The Rise Of Chipotle Stock

Chipotle Mexican Grill has seen a significant surge in its stock value, attracting the interest of investors and industry experts. As a major player in the fast-casual dining sector, Chipotle has experienced a substantial increase in its stock price in recent years. This has led to a closer examination of its performance and the factors driving this growth.

Historical Performance

Chipotle stock has demonstrated remarkable growth in recent years, surpassing market expectations and showing resilience in the face of industry challenges. This stability is a reassuring factor for potential investors.

Factors Driving Growth

- Please remember the following text:

- Demand for Healthier Options: Chipotle focuses on fresh, organic ingredients, which appeal to health-conscious consumers.

- Digital Innovation: The company’s investment in online ordering and delivery services has boosted sales and customer engagement.

- Social Media Presence: Chipotle’s active social media strategy has helped to connect with a younger demographic and drive brand awareness.

- Strong Leadership: Effective leadership and strategic decision-making have steered Chipotle toward sustainable growth.

Analysing Investor Behaviour

How investors act is a very important factor in determining how the stock market moves. What investors do and how they think can tell you a lot about how certain stocks are doing. When it comes to Chipotle stock, which is a popular choice among investors, understanding investor behavior becomes even more important.

Market Sentiment

Understanding market sentiment, or investor sentiment, is crucial for making informed investment decisions. It reflects investors’ overall outlook on a particular stock or the entire market, driven by emotions, perceptions, and expectations. This understanding can provide valuable insights into investors’ confidence in the company’s prospects.

With a strong focus on providing high-quality fast-casual dining experiences, Chipotle has been a giant in the food industry. When investors look at the company’s future growth potential, this dedication to quality is one of the most important things they look at.

Stakeholders need to assess key financial metrics as they provide insight into the company’s growth and profitability, helping gauge the potential future performance of the stock. Chipotle’s revenue has shown remarkable growth, reflecting its ability to attract and retain customers. Factors like menu innovation, digital sales channels, and strategic expansion have contributed to the steady increase in the company’s top-line revenue over the past few years. This growth trajectory indicates the company’s ability to capitalize on consumer preferences and effectively market its offerings.

Analyzing Chipotle’s profitability metrics reveals the company’s efficient expense management and ability to generate returns for stakeholders. The company’s profit margins have exhibited a consistent upward trend, showcasing its ability to control costs while expanding its market presence effectively. This sustained profitability is a positive indicator for investors, signaling the company’s ability to generate sustainable returns in the long term.

For those who own Chipotle stock, it is important to look at the company’s full financial performance to get a full picture of its growth prospects and economic health. Examining revenue trends and profitability metrics allows investors to make data-driven decisions that align with their investment objectives. This information provides a good indication of the continued growth and potential of investing in Chipotle stock.

Risks And Challenges

People who want to invest in Chipotle stock should know that there are a number of risks and challenges that come with it. Understanding these potential pitfalls will help investors make informed decisions. This article will discuss the main risks and problems associated with Chipotle’s stock, such as worries about food safety and issues with regulations.

Food Safety Concerns

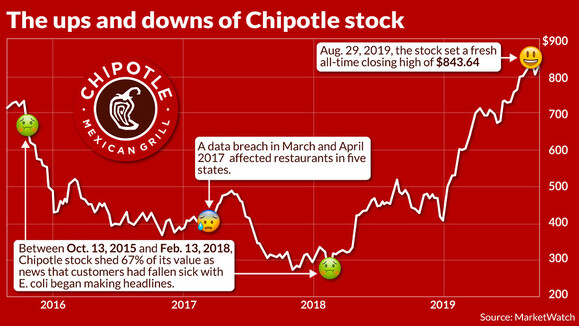

Chipotle has faced significant food safety issues in the past, including outbreaks of E. coli and norovirus. These incidents not only damaged the company’s reputation but also had a direct impact on its stock performance, leading to a decline in customer trust and reduced sales. Understanding these past events is crucial for investors to assess the potential risks associated with Chipotle’s stock.

Addressing food safety concerns is crucial for Chipotle’s profitability and stock value. Since the past incidents, the company has implemented stricter quality control and food safety rules to ensure that its ingredients are always fresh and safe. These efforts, including enhanced staff training and regular inspections, demonstrate Chipotle’s commitment to maintaining high standards of food safety, which is a positive sign for potential investors.

Despite these efforts, food safety concerns continue to pose a risk for Chipotle and its investors.

Regulatory Hurdles

Chipotle operates in a heavily regulated industry, which poses a significant challenge in terms of complying with government regulations. Factors such as food safety, ingredient sourcing, labor practices, and environmental sustainability are subject to changes in rules, which can impact the company’s operations and financial performance.

The industry is also constantly evolving, requiring Chipotle to adapt its business practices to meet new regulatory requirements promptly. The stock’s value can drop if you do not follow the rules. You might get fined, sued, or have your company’s reputation hurt if you don’t. Reputation. Performance. Maintaining awareness of regulatory changes and adhering to compliance measures is essential for Chipotle to minimize the impact of these obstacles on its stock value. Therefore, before making any investment decisions related to Chipotle, it is crucial to consider the risks and challenges associated with food safety concerns and regulatory compliance, as well as the company’s efforts to address these issues.

Future Growth Potential

The future growth potential of Chipotle stock looks promising with its strategic focus on expansion plans and innovation strategies.

Expansion Plans

Chipotle plans to open new locations and enter new markets to reach more customers.

Innovation Strategies

Chipotle is investing in technology to enhance the customer experience and improve operational efficiency.

Expert Market Predictions

Analyst Recommendations

Analysts suggest buying Chipotle stock due to its strong growth potential.

Stock Price Forecasts

The stock price is predicted to rise steadily over the next year based on market analysis.

Frequently Asked Questions For Chipotle Stock

What Is the Current Status of Chipotle Stock?

Chipotle stock has been performing well and has shown steady growth in recent months.

How Does Chipotle’s Stock Price Compare to Its Competitors?

Chipotle’s stock price is competitive and reflects its strong position in the market.

What Factors Influence Chipotle’s Stock Performance?

Several factors influence Chipotle’s stock performance, including financial results, market trends, and industry developments.

Should I Consider Investing in Chipotle Stock?

Investing in Chipotle Stock can be a good option, as it has shown resilience and potential for growth.

What are some risks that might come with buying Chipotle stock?

Like any investment, investing in Chipotle Stock carries certain risks that should be carefully considered.

Is Chipotle Stock Expected To Continue Its Growth In The Future?

Strategic initiatives and a strong brand presence are what are driving future growth for Chipotle Stock.

What Factors Contributed to the Increase in Chipotle’s Stock?

Chipotle’s stock saw a significant increase due to its robust financial performance, including consistent revenue growth and innovative business strategies. The company’s focus on high-quality, healthy ingredients has resonated with consumers, attracting investors who are eager to capitalize on its success in the fast-casual dining sector.

How Does Chipotle’s Commitment to Sustainability Impact Its Stock?

Chipotle’s dedication to using sustainable ingredients and eco-friendly practices has positively influenced investor sentiment. By aligning its business model with environmental responsibility, Chipotle enhances its brand image and attracts socially conscious investors, which contributes to the growing demand for Its stock.

Why Should Investors Consider Buying Chipotle Stock Now?

Investors looking to enter the restaurant business may find Chipotle stock particularly appealing due to the company’s strong financial performance and expansion plans. Chipotle’s innovative approach to menu offerings and customer experience positions it well for future growth, making it an attractive option for those interested in long-term investments in the fast-casual dining market.

What Role Does Customer Experience Play in Chipotle’s Stock Performance?

The customer experience is a crucial factor in Chipotle’s stock performance. The company’s commitment to enhancing the dining experience through personalized service and quality food has led to increased customer loyalty. This, in turn, drives revenue growth and positively impacts the stock’s performance, attracting more investors.

Is Chipotle stock a good long-term investment?

Given Chipotle’s consistent revenue growth, innovative strategies, and commitment to sustainability, many financial analysts consider Chipotle’s stock a good long-term investment. The company’s ability to adapt and expand its offerings positions it favorably in the competitive fast-casual dining sector, making it an appealing choice for investors looking for sustainable growth.

Conclusion

After analyzing the information, it appears that investing in Chipotle stock is a wise decision. The company’s strong growth, innovative approach to food, and commitment to sustainability position it for long-term success in the fast-casual restaurant industry. With a reputation for quality and a loyal customer base, Chipotle represents a promising investment opportunity for those looking to capitalize on the restaurant sector’s growth potential.

It’s important to monitor future developments and performance indicators to make well-informed investment decisions.

Leave a Reply